Fortune News | Mar 18,2023

Oct 16 , 2024

By Tilahun Esmael Kassahun

Ethiopia is on the brink of a financial revolution, with Ethio telecom, one of the country's most profitable enterprises, set to launch its Initial Public Offering (IPO). It is a landmark moment in Ethiopia's capital market history, offering an unprecedented opportunity for Ethiopians to participate in the country's economic growth. The new direction will embody a momentous step towards modernising Ethiopia's financial ecosystem, writes Tilahun Esmael Kassahun, CEO of the Ethiopian Securities Exchange (ESX).

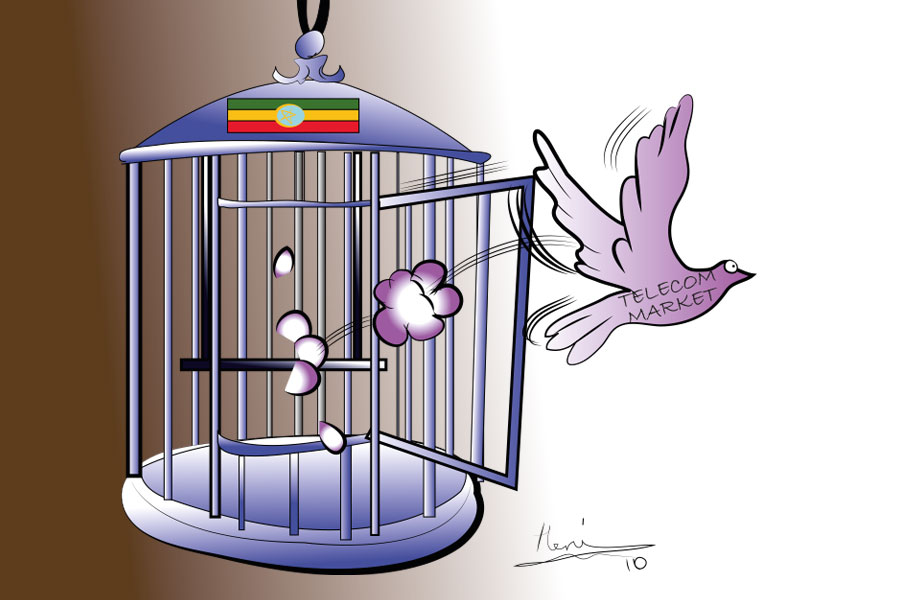

Ethiopia is at the threshold of a financial reel as Ethio telecom, one of the country's largest and most profitable companies, prepares to launch its Initial Public Offering (IPO). This landmark event is more than a mere corporate milestone; it marks a transformative moment in Ethiopia's capital market history and presents an unprecedented opportunity for Ethiopians from all walks of life to participate in the nation's economic growth. Ethio Telecom's IPO is poised to catalyse broader economic development, symbolising a momentous step toward modernising the country's financial ecosystem.

The Ethio telecom IPO, alongside the establishment of the Ethiopian Securities Exchange (ESX), forms an integral part of the government's strategy to deepen financial markets, promote private investment, and create wealth for its citizens. Ethiopia's capital markets have been underdeveloped for years, with the economy dominated mainly by small and medium-sized enterprises (SMEs) and a substantial informal sector. Ordinary Ethiopians have had limited avenues to participate in capital markets, and investing in publicly traded securities is a novel concept for many. However, this is a powerful step towards fostering a culture of investment and financial literacy.

The introduction of the Ethiopian Securities Exchange is set to play an indispensable role in this transformation. As the country's first securities exchange, we are committed to educate the public on the value of investing in regulated securities. By cultivating a culture of investment and financial literacy, the ESX empowers Ethiopians to participate actively in capital markets. Ethio telecom's IPO is expected to serve as a model for future listings, where broader participation, transparency, governance, and accountability become the foundation of Ethiopia's capital market.

As this capital market evolves, more companies will likely seek funding through equity and debt instruments, paving the way for a thriving ecosystem. This development is anticipated to attract considerable foreign portfolio investment, providing much-needed capital to Ethiopian entrepreneurs and stimulating economic growth. Modernising the capital market infrastructure will benefit large corporations and create opportunities for small and medium-sized enterprises to access funding.

Looking ahead, optimism abounds.

Ethio telecom's IPO is only the beginning of what could become a flourishing capital market supporting the economic aspirations of the Ethiopian people. The aim is to create a market that is inclusive, transparent, and accessible to all, whether institutional investors or first-time retail investors. By providing a platform that empowers everyone to be part of Ethiopia's financial future, the Exchange is laying the foundation for a more equitable and prosperous society.

With the growth of the capital market, increased regulatory oversight by the Ethiopian Capital Market Authority (ECMA) and the ESX, acting as a self-regulatory organisation, is expected. The introduction of investment banks, brokerages, asset managers, and fund managers will enhance the quality of offerings by issuers. These entities will facilitate the aggregation of capital into various collective investment funds, promoting broader participation by retail investors and contributing to the overall stability and efficiency of the market.

Modernising the market will also attract substantial foreign portfolio investment, providing funding to Ethiopian entrepreneurs. However, as the capital market ecosystem develops, certain areas require clarification to ensure all stakeholders understand the new structures and processes.

One such area is the distinction between the primary and secondary markets.

In the primary market, securities are issued for the first time and sold directly to investors by the issuing company, like Ethio telecom, to raise capital. An essential process in the primary market is the IPO, which typically involves a set of successive steps including engaging investment banks, submitting regulatory filings, pricing shares, and completing the public offering. On the offering date, shares are sold to the public, and the company receives the proceeds. After the IPO, the company's shares are listed and traded in the secondary market — here, the Ethiopian Securities Exchange (ESX) — where investors buy and sell securities among themselves.

To date, Ethiopia's primary market has been unregulated and inefficient. Issuers often spend months, even years, waiting to sell shares to the public during the offering stage. In one instance, a company seeking to raise capital had to wait over two years to complete its offering due to regulatory hurdles. This scenario contrasts sharply with most modern capital markets, including those in other African countries.

Modern markets have established safe, transparent, and efficient systems with contributions from regulators and intermediaries like investment banks and institutional investors. Ethiopia's capital market ecosystem is set to develop similarly. The Ethiopian Capital Market Authority (ECMA) and the Exchange, along with the licensing of investment banks, brokerages, and domestic and foreign institutional investors, will reduce the time to market for many issuers.

The Exchange plays a critical role as a central platform for liquidity, transparency, and price discovery.

Contrary to recent media coverage, the primary offering of Ethio telecom's shares was not expected to occur on the Exchange's trading platform. Rather, once investors fully subscribe to Ethio telecom's publicly offered shares, they will be listed on the Exchange for secondary market trading. This approach aligns with global best practices and ensures investors have a regulated and efficient platform for buying and selling securities after the IPO.

The modernisation of Ethiopia's capital market infrastructure is set to revolutionise both the primary and secondary market ecosystem. Until now, shareholders often lacked a regulated and efficient platform for buying or selling their securities after purchasing them in the primary market. Investors relied on informal channels, including social media and personal networks, making price discovery challenging and compromising transparency. Such efficient price discovery and liquidity will significantly improve the efficiency of the primary market.

With the advent of the Exchange, all publicly traded securities, including shares, treasury bills, bonds, and sukuks, will be dematerialised. Hence, investors participating in offerings like Ethio telecom's IPO will have securities trading accounts within the central securities depository established under the National Bank of Ethiopia (NBE). They will be able to subscribe to upcoming IPOs or engage in secondary market trading through preferred market intermediaries, such as securities brokers or investment banks.

Securities trading will become fully electronic, leveraging modern technology to enhance accessibility and efficiency. Ethiopians across the country, as well as foreign investors, will be able to approach exchange trading members to buy or sell securities. They can also use web-based and mobile trading applications provided by the Exchange and its members to participate directly in the market. This safe, trustworthy, and efficient market is expected to enhance investor confidence and liquidity, attracting many issuers like Ethio telecom and investors worldwide to the Ethiopian capital market.

Undoubtedly, Ethio telecom's IPO marks the dawn of a new era. The IPO will be one of the Exchange's flagship listings, putting ESX and Ethio telecom on the map of global indices. It manifests Ethiopia's commitment to becoming a robust and modern financial hub, capable of attracting global investment and stimulating domestic economic growth.

PUBLISHED ON

Oct 16,2024 [ VOL

25 , NO

1276]

Fortune News | Mar 18,2023

Sunday with Eden | Aug 25,2024

Radar | Jul 17,2022

Commentaries | Sep 10,2023

In-Picture | Sep 14,2024

Editorial | May 29,2021

Radar | Jan 19,2024

Fortune News | Jul 17,2022

Editorial | Jun 21,2025

Radar | Oct 22,2022

My Opinion | 131974 Views | Aug 14,2021

My Opinion | 128363 Views | Aug 21,2021

My Opinion | 126301 Views | Sep 10,2021

My Opinion | 123917 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jul 6 , 2025 . By BEZAWIT HULUAGER

The federal legislature gave Prime Minister Abiy Ahmed (PhD) what he wanted: a 1.9 tr...

Jul 6 , 2025 . By YITBAREK GETACHEW

In a city rising skyward at breakneck speed, a reckoning has arrived. Authorities in...

Jul 6 , 2025 . By NAHOM AYELE

A landmark directive from the Ministry of Finance signals a paradigm shift in the cou...

Jul 6 , 2025 . By NAHOM AYELE

Awash Bank has announced plans to establish a dedicated investment banking subsidiary...